By keeping track of both balances, you can find better ways to budget your funds. The available balance allows you to view the current funds you have while deposits are still processing, which you can rely on to avoid overdraft fees. In some cases, such as with new bank accounts or very large deposits, the bank may put what’s called an exception hold on deposits.

Can I Withdraw the Current Balance or the Available Balance?

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

Which balance is the most accurate?

Each depositor is insured to at least $250,000 per depositor, per insured bank, per ownership category. The Experian Smart Money™ Digital Checking Account and Debit Card helps you build credit without the debtØ—and with $0 monthly fees¶. Download Rocket Money for free on the iOS and Google Play stores – or sign up online today.

Money worries

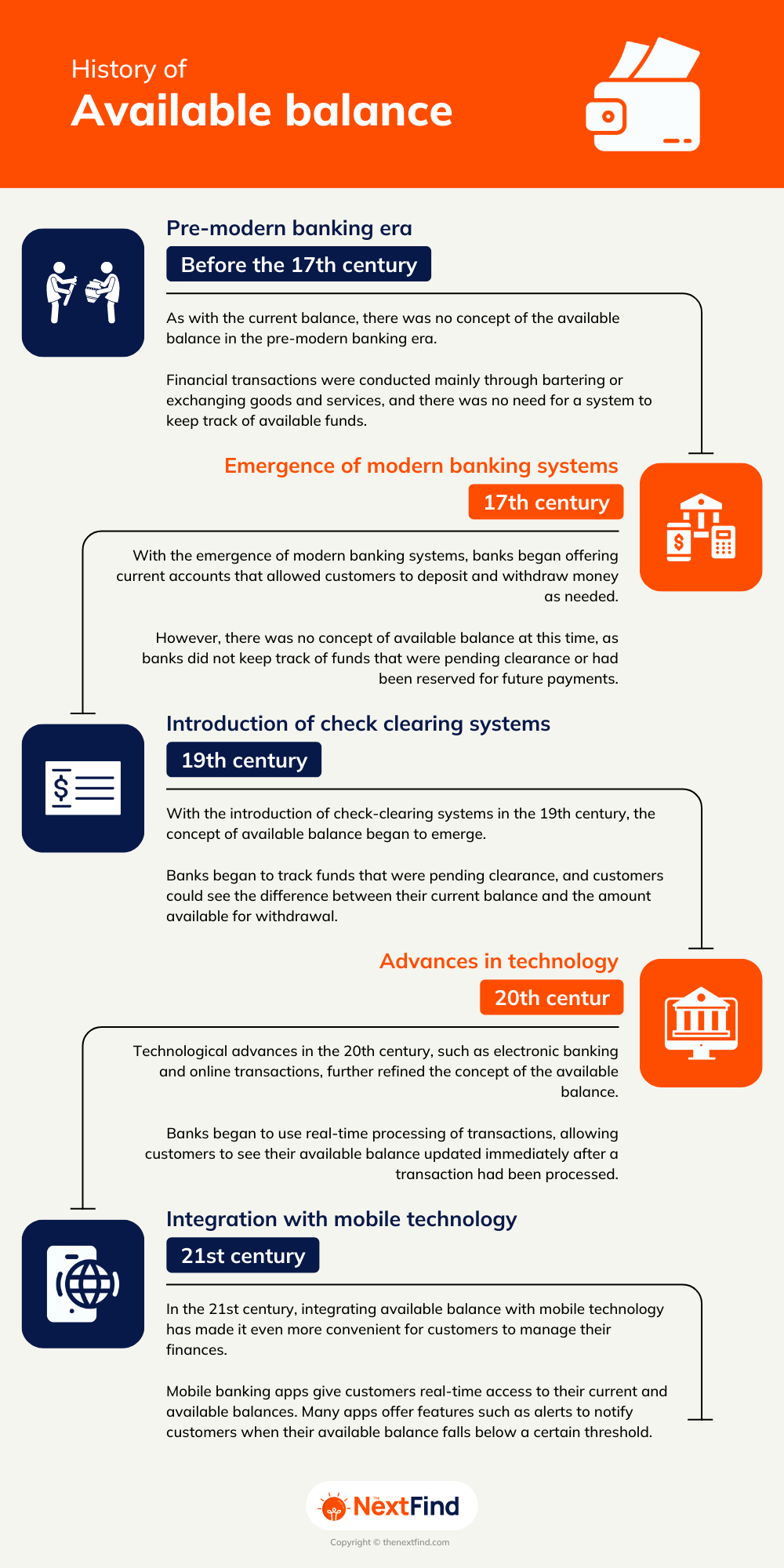

Account balance refers to the total amount of money in a bank account, including both deposited funds and any pending transactions. On the other hand, available balance refers to the amount of money that can be accessed or used immediately. It takes into account any holds or restrictions placed on the account, such as pending transactions or overdraft limits. While account balance provides an overview of the account’s funds, available balance is a more practical indicator of the actual funds that can be utilized at a given moment. Once a pending transaction is reflected in your ledger, it will generally clear within 24 to 72 hours, but it can take longer. For example, merchant payments initiated electronically can take 24 to 36 hours to hit your account and linger in pending status for another 24 to 48 hours before posting.

How We Make Money

- The current balance on your bank account is the total amount of money in the account.

- Your current balance, sometimes called your present balance, is the money in your account, including all deposits and debits posted up to that date.

- If you’re looking for a new bank, check the financial institution’s policy on overdrafts and insufficient fund fees in the account disclosures before signing up.

Her articles are published in leading publications, like Banks.com, Bankrate, The Wall Street Journal, MSN Money, and Investopedia. When she’s not busy creating content, Allison travels nationwide, sharing her knowledge and expertise in financial literacy and entrepreneurship through interactive workshops and programs. She also works as a Certified Financial Education Instructor (CFEI) dedicated to helping people from all walks of life achieve financial freedom and success.

Knowing how much you have available can help you avoid overdraft fees when making purchases or bill payments. Your current balance is the total amount of money presently in your bank account, which may include pending transactions like credit card payments, deposits and more. Depending on your recent activity, it’s also possible for your current balance to match your available balance. Your current balance shows the funds in a checking or savings account. The available balance is the amount of money you have for cash withdrawals and purchases. This amount typically includes pending transactions and holds the bank places on deposits you’ve made.

Regularly logging into your bank account can help you stay up to date on your transactions and available balance. It might also help you spot fraudulent charges so you can dispute them. Free credit monitoring with Experian takes it a step further and alerts you whenever something new shows up on your credit report. Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP.

Other pending transactions won’t be reflected in your available balance, such as cheques that haven’t cleared and Direct Debits. But when you log in and see two different figures for your available balance and your posted balance, do you know which one to go by? 2 The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after funding your Account. The interest rate and APY for your CD will be fixed and will either be (i) the rate reflected at application submission or (ii) the rate being offered when your CD is funded, whichever is higher.

You can use any amount up to $1,000 without incurring extra fees or charges from your bank. You may go into overdraft and incur penalty fees if you go beyond that. Julia Kagan is a financial/consumer journalist what is the difference between account balance and available balance and former senior editor, personal finance, of Investopedia. It shows you how much you could have left for the month ahead, once scheduled bills (based on previous spend) are taken into account.